Connect with me:

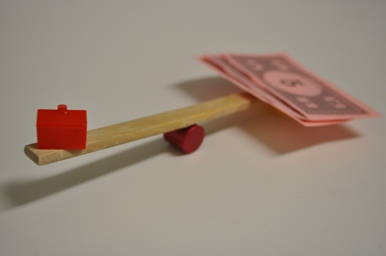

The reality is that no one can really predict the future of the housing market, but there are several factors that influence it. By identifying these factors and the direction they are going, we can make some educated predictions about housing.

The reality is that no one can really predict the future of the housing market, but there are several factors that influence it. By identifying these factors and the direction they are going, we can make some educated predictions about housing.

For me, recovery means three things need to happen on a consistent basis:

- Buyers want and are able to buy.

- Sellers want and are able to sell.

- Home values stabilize and start to increase.

Let’s look at where each of these factors are today and what direction they are going in.

Buyers Want and Are Able to Buy

The three biggest deterrents to buyers buying homes today are declining values, an unhealthy job market, and a lack of access to credit. It is hard to commit to one of the biggest purchases of your life and commit to thirty years of mortgage payments when you are not sure your job is secure, your salary is secure, and the value of your home is secure. Those that somehow do overcome these concerns do not necessarily qualify for a mortgage because credit has become so tight. A fourth factor is many buyers that would like to buy a new home can’t because they cannot sell their current home; this factor is covered in the next section.

Home values will stop declining when distressed properties stop putting a strain on the housing market. The good news on this front is that the number of delinquent mortgages has begun to slow. Assuming unemployment does not become worse so homeowners are able to keep up with their payments, it appears the worse of the foreclosure crisis is behind us. This means we are near the bottom, and home values will stop declining.

The job market continues to plague the economy. There are stories here and there of jobs being created in certain sectors, but confidence remains low, and job creation continues to be inadequate. When the job market starts to improve and confidence starts to improve, more buyers will be willing to commit to a mortgage knowing that home values are close to stabilizing.

Access to credit has decreased over the last year. Among other things, minimum FICO scores needed to qualify for the best interest rates have increased, and changes in FHA loan requirements, including an increase in monthly Mortgage Insurance Premium (MIP) fees, have prevented many buyers from qualifying for a mortgage. To add to the already jittery mortgage market, there are two upcoming decisions that could further restrict access to credit: the proposed 20% down payment for a Qualified Residential Mortgage (QRM) and the expiration of government backed loan limits which would lower these limits to an amount that is less than an average single family home sells for in Northern Virginia. The pendulum has swung from one extreme (too easy access to credit that brought on the meltdown) to the other extreme (very limit access to credit). When the lending industry finds the balance in the middle, qualified buyers will once again have access to credit and can begin buying again.

Sellers Want and Are Able to Sell

Right now, the majority of the housing market is made up of distressed homes—foreclosures and short sales—and sellers that have to sell because of changes in family situations or need to relocate for work or family. Many homeowners are underwater so are not able to sell; others do not have to sell so prefer to wait until values improve. The key to all of this is an improvement in home values. When values start to improve, fewer homeowners will be underwater which will allow them to sell, and the remaining homeowners will be more willing to sell because they will not be losing as much equity as they are now.

Home Values Stabilize and Start to Increase

As stated earlier, it appears values are close to stabilizing. Values will probably not rise much until the mortgage industry perfects and starts speeding up the foreclosure process which came to a grinding halt last fall during the robo-signing debacle. At the current national sell through rate, it could take up to 12 years to work through the current and “shadow” foreclosure inventory. While most agree that it will not take this long for home values to start to increase, values will probably remain flat for a number of years.

So where do we stand?

We are near the bottom of the housing market where home values will start to stabilize, but until the job market and access to credit improve, the pool of buyers will be limited. Once buyers start buying and lenders whittle down their inventory of foreclosures, the increased demand for housing and dwindling supply of distressed properties will cause home values to increase, allowing more sellers to enter the housing market.

Through the end of the year, we need to watch how QRM requirements and loan limits impact access to credit as well as how the job market improves.

Share:Connect with me:

I know this economy is tough right now with people wanting to buy and sell their home for various reasons, but be careful and don’t sell your home too low if you can help it. I talked with a local realtor about me relocating to another state. He asked why I wanted to sell and I told him I was ready to relocate to another city and state since I didn’t have a a husband or children. I also made it very clear to him that I was paying my mortgage, was not behind on my mortgage, had not missed a mortgage payment and was employeed. I simply wanted to relocate (I’m one of those people who will research a new city / state and decide to pick up and live, which is why I’ve realized that me being a home buyer is probably not the best thing for me right now until I settle down a bit). This realtor suggested that I do a short sale or let the home go into foreclosure. WHAT? Why would I do that and ruin my credit? It’s not like I have to sell right now. I would like to sell now but I don’t have to if this housing mkt shows signs of improvement within the next 12 months. If I sell now I will definitely take a loss of $12,000 to $15,000 but compared to other people who bought homes after me or before me in this neighborhood I think if I sell now and take the loss I’ll be ok b/c I’m still young and can hopefully recover that monetary loss in a year or so.

Hello, and thank you for your comment. I’m very surprised that your Realtor recommended that you do a short sale or let the home go to foreclosure. Realtors are not lawyers or accountants, and we should let that kind of advice be left to the experts. As a Realtor, I try my best to provide the most accurate information I can about the housing market so that my clients can make the best choices for their situations.

Hello! I am looking at a change in careers. I have always wanted to sell real estate but with the market in shambles, would this be a bad time for me to get into sales?

Thank you for your comment! This is not the easiest of times to get into real estate, but there are a lot of real estate agents that are having some of their best years during this time. The housing market has to recover at some point; we are not going to be limping along forever. My logic tells me it is better to be in real estate when the market turns around–having already established yourself, your business, and learned the ropes so that you are an expert–than to just be starting when the market turns around. If you wait until the market is already on the upswing, you will be playing catch-up, rather than being on the frontlines.

Now having said that, being a real estate agent even during a healthy market takes a lot of dedication, hard-work, persistence, and patience. You do not become a success overnight, and many get discouraged and give up before becoming successful. A great way to test the waters is to work as an assistant for a successful real estate agent. This allows you to learn everything you can, allows you to see if you like the industry, and allows you to have a steady paycheck, if that is important to you.

I’d love to hear how your adventure continues! Keep me posted!

Thanks for the info. Found this page on google page 1 and it’s really helpful.

Thank you for the comment. Enjoyed reading your blog as well.

Thank you for your common sense outlook at the housing market.

Thank you for the comment. I appreciate your feedback.

Came across your post and it is a year after and it seems that nothing change. Is there some hope out there? M and my wife want to by a house but it seems impossible to get qualified for a mortgage.