Connect with me:

Every Thursday, Freddie Mac publishes weekly national mortgage rates. Last Thursday, somehow the 15 year fixed rate caught my eye. It was 3.74%–not a teaser rate, not an adjustable rate that will increase, the same rate for 15 years, and then there are no more mortgage payments.

Every Thursday, Freddie Mac publishes weekly national mortgage rates. Last Thursday, somehow the 15 year fixed rate caught my eye. It was 3.74%–not a teaser rate, not an adjustable rate that will increase, the same rate for 15 years, and then there are no more mortgage payments.

The 15 year fixed rate is three quarters of a percent lower than the 30 year fixed rate, which is still at an astoundingly low 4.55%. Most people refinance their mortgage to lower their monthly payments, but these low 15 year rates offer another reason to refinance–retirement. With the viability of social security in question, a lack of retirement savings, and a longer lifespan than many have planned for, Americans are looking for ways to fund their retirement years.

Have you considered refinancing to a 15 year fixed rate? Yes, it will increase your monthly payment, but you will pay the loan off in less time and save $10,000’s in interest. Once your mortgage is paid off, you will be living rent free which is the equivalent of increasing your monthly income by your mortgage amount.

Another way to use this option is to purchase an investment property. A recent survey of investors by Move Inc revealed that nearly half of today’s investors expect to receive at least a 20% return on their investment. I’ve even talked to my parents about doing this–targeting several local properties that would be a great investment for them. A wise purchase of an investment property will give you extra monthly income while you pay the mortgage, and 15 years later when the mortgage is paid off, the rent will be an extra source of monthly income.

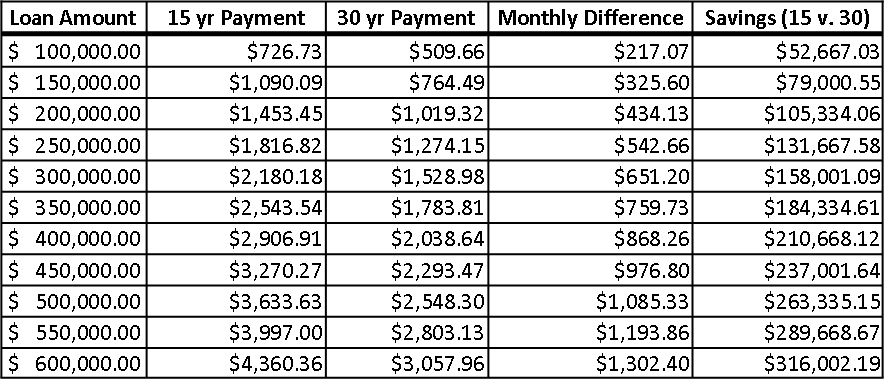

Here is a chart of possible scenarios (actual scenarios may vary). Please consult your financial advisor and/or accountant to see if this option might make sense for you.

Is this an option that might help you? Call me for loan officer recommendations or for help finding that perfect investment property!

Is this an option that might help you? Call me for loan officer recommendations or for help finding that perfect investment property!

| Loan Amount | 15 yr Payment | 30 yr Payment | Monthly Difference | Savings (15 v. 30) |

| $ 100,000.00 | $726.73 | $509.66 | $217.07 | $52,667.03 |

| $ 150,000.00 | $1,090.09 | $764.49 | $325.60 | $79,000.55 |

| $ 200,000.00 | $1,453.45 | $1,019.32 | $434.13 | $105,334.06 |

| $ 250,000.00 | $1,816.82 | $1,274.15 | $542.66 | $131,667.58 |

| $ 300,000.00 | $2,180.18 | $1,528.98 | $651.20 | $158,001.09 |

| $ 350,000.00 | $2,543.54 | $1,783.81 | $759.73 | $184,334.61 |

Connect with me: