Connect with me:

The National Association of Realtors (NAR) published their latest statistics last week that indicated pending home sales are on the rise for the eighth straight month. This, along with a decrease in inventory, has prompted many to declare that the housing market is stabilizing, and the bottom has been seen. It is true that there has been a surge in buying activity in the last several months, and it is true that inventory has been decreasing over the last several months, but the reasons these two conditions exist are not because the real estate market is stabilizing…yet.

I love the movie Field of Dreams! As one of my clients likes to say, “Margie, you’re dating yourself.” Perhaps, but you should still see the movie if you haven’t!

There’s a great scene in the movie where Shoeless Shoe Jackson is coaching newbie Archie Graham when he’s up to bat. “The first two were high and tight,” Jackson observes, “so where do you think the next one’s gonna be?” A very nervous Archie responds, “Well, either low and away, or in my ear.”

“He’s not gonna wanna load the bases, so look low and away.”

“Right.”

But as he’s walking back to the sidelines, Jackson adds, “But watch out for in your ear.”

Like Jackson, we might look at recent statistics and conclude, as some have, that the housing market is starting to recover, but also like Jackson, we need to watch out for in our ear! There are several factors that cause me to question whether the housing market is truly on the road to recovery.

Surge in Buying Activity

Nationwide, the number of home sales is rising, but those numbers are fueled by the lowest end of the housing market–almost half of those sales, 48.3%, are for homes priced between $100,000 and $250,000 (Source: NAR). The impending expiration of the first-time home buyers tax credit fueled some of this activity, especially during the last two months. What you do not hear a lot about are the investors that are jumping in to the market in large numbers. One figure I saw indicated that 42% of those intending to buy were not planning on living in the property. Investors are diving in to the low end of the market, often with cash in hand, to snap up deals at the bottom either for flipping or for renting out.

Decrease in Inventory

Last winter, in anticipation of the Federal Government passing legislation that addressed loan modifications, Fannie Mae and Freddie Mac put a 90 day moratorium on processing foreclosures. They wanted to wait and see what guidelines and incentives the government passed. Many of the large lenders such as Citigroup, JPMorgan Chase, Bank of America, Morgan Stanley, and Wells Fargo agreed to do the same. The moratorium lasted at least through the middle of March, 2009, and in some cases through July, 2009. In addition, HAMP (Making Homes Affordable Program) encouraged lenders to work with borrowers who fell behind on their loans rather than initiating foreclosure proceedings. As a result, there is a gap in the foreclosure pipeline. The current low inventory can partially be attributed to sellers waiting out the current real estate market, but it can also be attributed to the moratorium.

What Do the Statistics Say About…

… Buyers

This is actually a bit of an unknown. We know that for the last 6 months, the tax credit, low interest rates, and low prices brought a surge of first time home buyers and investors into the market. A lack of inventory due to a moratorium on the foreclosure process created a lack of supply that caused bidding wars in some some neighborhoods at the low end of the market. The move-up market and the middle to upper end of the price scale were not really affected by this phenomenon. It is unclear what effect the extension of the first-time home buyer tax credit and addition of the move-up buyer tax credit will have on buyers. If it does have an effect, it will only last until April 30, 2009–the deadline for contract ratification in order to take advantage of the tax credit.

… Interest Rates

The more immediate question, I think, is what effect will interest rate have on buyers. Up until now, mortgage interest rates have been kept artificially low by the Fed’s purchase program of MBS–Mortgage Backed Securities. This program is due to end in March, 2010. It is widely anticipated that when the MBS purchase program ends, mortgage interest rates will increase.

… Current Mortgage Defaults

Under the best case scenario, those borrowers that were in jeopardy of foreclosure would be able to get caught up either through loan modification or some other means. The ability and/or desire to stay caught up is contingent on two things: home value and employment. While negative equity is improving, Zillow’s latest statistics indicate that 21% of US single family homes with mortgages are underwater. Some homeowners, believing that they will never see equity in their homes, are mailing their keys to their lender and walking away. Unemployment figures reached double digits for the first time in 26 years–rising to 10.2% in October. This continues to put more families in jeopardy of not keeping up with their mortgage payments.

… Foreclosure Inventory

We are still waiting on statistics that will indicate to what extent HAMP modifications have succeeded. There is evidence that the default rate on modified loans is subtantial. In the meantime, we have other statistics that point to a sobering future. The Mortgage Bankers Association reports that 14.41% of US households with mortgages are either behind on their payments or are in the foreclosure process (updated 11/19/09). RealtyTrac reports that within the foreclosure inventory, only 23% is actually bank owned right now. 37% of the inventory is in pre-foreclosure, and 39% of the inventory is in auction status.

Lender Processing Services reported in October that the number of loans deteriorating into delinquent status is twice the number of foreclosure starts; this is the “shadow” inventory that you might be hearing about. Furthermore, the six-month average deterioration ratio has risen the past two months to 300%. The default rate is far outpacing the liquidation rate causing this shadow inventory to increase dramatically.

… A New Wave of Loan Defaults

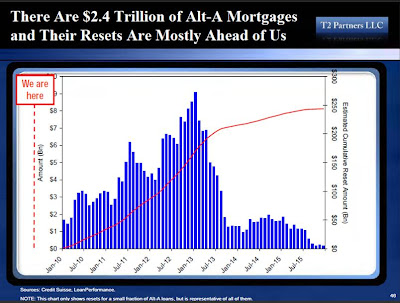

While the sub-prime defaults are mostly behind us, statistics show that most of the Alt-A defaults are soon to come according to T2 Partners LLC.

So back to my question from my last blog post, “What would I do if it was my mom and dad?” I still think it’s a great time to buy and take advantage of low interest rates and low prices…providing you can heed Shoeless Joe Jackson’s warning and watch out for in your ear. The housing market will recover; there will be another side to all of this in the long term. In the short term, realize that we are still in cleaning-out-the-closet mode where things look worse before they get better. We may see another dip in the housing recovery if inventory increases with the shadow foreclosure inventory and demand declines with an increase in interest rates and the current tax credit expiration.

We are back to fundamentals–buy only what you can afford; assume equity will be earned by paying down principle, not by home values skyrocketing; and prepare for rocky times by saving and not overextending.

Share: Connect with me: