Connect with me:

If you’re like a lot of Americans, you might not be ready to buy a home right now. At a time when job security is shakey, the U.S. economy continues to stumble, and almost a quarter of U.S. homeowners are underwater with negative equity, it’s hard to get excited about buying a home.

If you’re like a lot of Americans, you might not be ready to buy a home right now. At a time when job security is shakey, the U.S. economy continues to stumble, and almost a quarter of U.S. homeowners are underwater with negative equity, it’s hard to get excited about buying a home.

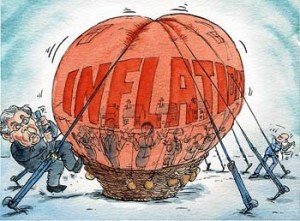

Today, I heard the phrase, “protect against inflation,” and I realized that no matter how many good reason there are to not buy a home, there is one very important reason to buy a home–your future financial health.

The economy will recover, and the job market will strengthen. Along with that recovery, interest rates and home values will go up. We are already seeing a surge in rental prices because those that are looking for a new home are not buying, putting tremendous demand on the existing rental market. I had two clients in the last six months that were able to rent their condos out for at least $250 a month more than they did last year–great for them, not great for all the renters out there.

Even in the worst housing market, if you have a thirty year fixed mortgage, at the end of thirty years, you will have paid the house off, and that equity is yours. You can’t pay off a mortgage and end up owning a home free and clear if you are a renter. We are in the perfect moment to buy a home–low prices, low interest rates, and rental rates that are going up faster than the cost of living.

Buying a home today will protect you against tomorrow’s inflation when housing prices will be higher, interest rates will be higher, and the alternative to owning–renting–will also be higher.

Share:Connect with me: