Connect with me:

On December 23, 2011, Congress voted to extend the payroll tax cut for 2 months. The extension is being paid for by increasing and then diverting the fees that Fannie Mae and Freddie Mac charge banks to protect against credit-related losses on a mortgage portfolio. These fees are called guarantee fees or “g-fees,” and they are usually 15-25 basis points.

On December 23, 2011, Congress voted to extend the payroll tax cut for 2 months. The extension is being paid for by increasing and then diverting the fees that Fannie Mae and Freddie Mac charge banks to protect against credit-related losses on a mortgage portfolio. These fees are called guarantee fees or “g-fees,” and they are usually 15-25 basis points.

Congress voted to raise the guarantee fees that Fannie and Freddie charge beginning April 1, 2012 by 10 basis points, and these funds will be used to pay for the payroll tax cut extension. It is assumed that banks will pass this extra expense along to borrowers, and I have heard that mortgage interest rates will increase anywhere from .125% to .25% as a result. Some lenders have already started to increase their fees in anticipation of the April 1 increase.

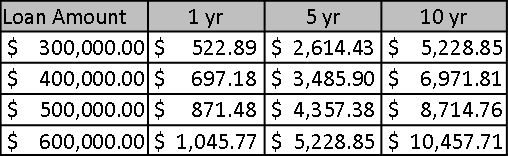

If you’re thinking about buying a home, now might be a good time to do that! Below is a chart that shows how much more it will cost you to borrow money if rates go from 4% to 4.25%.

Share:Connect with me: