Connect with me:

They are in, and they are encouraging! The March 2011 housing statistics were just released.

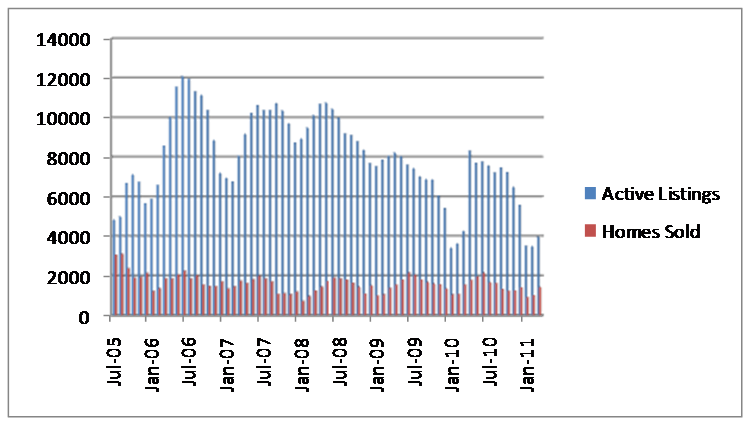

The number of homes sold each month finally started to trend up in March after a relatively steady decline since the summer. Inventory is also starting to rise since a sharp decline in October as a result of the robo-signing mess (see my previous post). We have needed inventory to rise for two reasons: buyers need more homes to choose from, and we really need to work through the foreclosure inventory.

The number of homes sold each month finally started to trend up in March after a relatively steady decline since the summer. Inventory is also starting to rise since a sharp decline in October as a result of the robo-signing mess (see my previous post). We have needed inventory to rise for two reasons: buyers need more homes to choose from, and we really need to work through the foreclosure inventory.

There is a larger pool of buyers on the market. Many of the buyers that are purchasing right now are doing so with an FHA mortgage. The FHA insurance premiums went up on Monday, April 18. Many buyers were trying to lock in a contract in order to take advantage of the lower insurance premiums. Even though these premiums are now a bit higher, FHA continues to be an attractive loan because it only requires a 3.5% downpayment as opposed to a 20% downpayment for a conventional loan. The increase in interest rates has created more of a sense of urgency among buyers as well. Buyers today are looking for homes that do not require much work or updating. There is not much on the market that meets that criteria so when something does come on the market, there is often a bidding war. More inventory will allow buyers to make thoughtful offers instead of hurried offers.

As much as I’d like to see the number of foreclosures declining, I know that there is a tremendous amount of shadow foreclosure inventory (mortgages that are in default but have not been taken over by the lender). We are not seeing them hit the market because lenders stopped processing foreclosures last fall in order to fix the process to avoid the robo-signing mistakes. It doesn’t mean there are no foreclosures; it just means those foreclosures are just sitting there waiting to be taken over and re-sold. The sooner we can get through these foreclosures, the sooner we can return to a more normal housing market. It’s encouraging to see inventory rising after the sharp drop last October.

Are you thinking of selling your home or buying a home, but you haven’t pulled the trigger on doing it? I would love to hear your thoughts on why. Please comment!

Share:Connect with me: